Retirees are consistently charitable. They are the largest group of Americans supporting the many non-profits and charities that rely donations for survival. So what happens now that the new Tax Overhaul Bill is a reality?

Retirees that used to itemize deductions used their property taxes, perhaps state income taxes, and their charitable contributions to reduce their taxable income. Now, there are two fixed levels: $12,000 for individuals; $24,000 for married couples. So the question for charities now is, will the benefit of those charitable contributions disappear? Maybe not.

It’s nothing new, but the strategic method for those 70-1/2 and older to reduce taxable income by giving their entire RMD (Required Minimum Distribution) directly to charity is still a good one. But now, you might want to give twice as much every other year if that results in an amount to write off that is larger than the standard deduction.

Let’s say you are retired but not yet 70-1/2. You don’t have a Required Minimum Distribution, but you may want to take a distribution (earmarked for a charity) in order to avoid being in a higher tax bracket. It’s a painless way to give to charity or support the causes and missions that you care about so deeply.

For certain income levels, you might want to consider a Donor-Advised Fund (DAF). These funds—sort of like personal private foundations, without all the legal and accounting costs—allow contributors to donate money and take a tax deduction in the same year, then pay the money to selected charities over time. There are interesting advantages for a DAF. If you missed the 2017 cut-off, you might want to have a conversation with us to see whether either RMD or DAF plan could be to your (and your charity’s) advantage going forward.

Call us for free, no-obligation consultation or refer us to a friend you know who may need our expertise and experience.

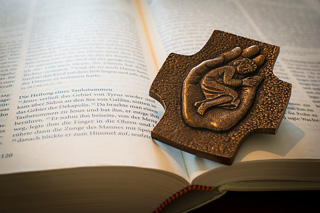

Bethesda Healing Ministry on Dover Road in Columbus is a Catholic Christian ministry that for 22 years has served men and women suffering the effects of abortion in the spirit of the biblical Bethesda. The Stewardship Foundation has supported the ministry financially for several years, and is blessed for having done so. In April, we attended their Annual Event Dinner where the ministry hoped to raise $150,000 to fund their vision to extend “the arms of outreach” in Ohio. Up to now, the ministry has been run strictly by volunteers at no pay but now foundress Judy Schlueter feels they need to fill new leadership and staffing positions and broaden their reach so that more suffering people can experience healing.

Bethesda Healing Ministry on Dover Road in Columbus is a Catholic Christian ministry that for 22 years has served men and women suffering the effects of abortion in the spirit of the biblical Bethesda. The Stewardship Foundation has supported the ministry financially for several years, and is blessed for having done so. In April, we attended their Annual Event Dinner where the ministry hoped to raise $150,000 to fund their vision to extend “the arms of outreach” in Ohio. Up to now, the ministry has been run strictly by volunteers at no pay but now foundress Judy Schlueter feels they need to fill new leadership and staffing positions and broaden their reach so that more suffering people can experience healing.